TRL Levels are BS...

I’m going to get a lot of flack for this one.

I hate TRL (Technology Readiness Level) scales when evaluating technologies for success. Not mildly dislike. Hate.

And here’s why.

The Shelf of Forgotten Technology

We already have immense technology developed by the federal government that just… sits there.

When I worked at Sandia National Laboratories, I noticed something striking: many of the technologies were 10–15 years ahead of industry. And yet—they weren’t going anywhere.

Clearly, the problem isn’t whether the technology exists.

So What’s the Actual Problem?

The core issue is that TRL levels mismatch technologies to capital markets.

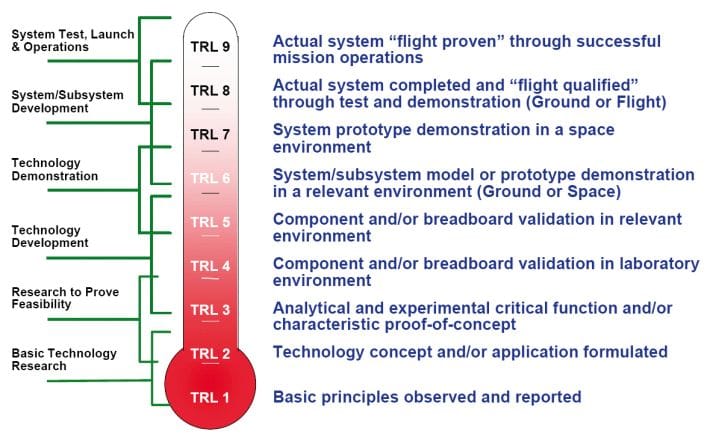

When technology-commercialization theory was still young, TRLs were a convenient framework. They describe where a technology is in its development lifecycle—from concept to deployment. That’s fine. But somewhere along the way, TRLs became dogma.

People now use them as a proxy for investability. Which is clinically insane.

TRL Is a Procurement Tool, Not a Success Predictor

TRL was designed for one narrow question: “Can I use this yet?” It was never designed to answer: “Will this technology succeed?”

That distinction matters. TRL is a procurement framework, born out of the military-industrial complex. It tells you readiness for use—not economic viability, scalability, or market survivability.

Yet today, it’s routinely used as a stand-in for commercial risk analysis. That’s a category error.

Deterministic Failure Modes

When I look at deeply technical hardware startups, I keep seeing the same pattern: projects continue far too long because they have deterministic failure modes early on—but those flaws get “objection-handled” away.

Ironically, the more egregious the flaw, the more aggressively it’s minimized. This is why some ventures:

- Raise massive early rounds ($100M+)

- Look unstoppable on paper

- Hit a brick wall at project finance or later-stage capital.

Eventually, they are subjected to real scrutiny, and the house of cards collapses.

A Real-World Example of Bad Reasoning

Here’s a pattern I see constantly:

A: “The technology is unbelievably expensive.”

B: “But one day it won’t be.”

A: “How?”

B: “Computers used to be expensive. Now they aren’t.”

These aren’t arguments; they’re sales tactics. Sales is fine—but someone still has to be accountable to physics, manufacturing reality, and capital intensity.

Objection Handling vs. Actual Analysis

This problem persists because many investors come from elite schools which, coincidentally, don’t teach sales.

As a result, people confuse two very different things:

- Real analysis of scaling effects: (Physics -> Manufacturing Assumptions)

- Taglines that sound like analysis.

Entire ventures are being built on flawed chains of reasoning that no one rigorously stress-test.

The Military Actually Does This Better

Ironically, when scaling mission-critical technologies, the military-industrial complex (at least the competent parts) uses far deeper frameworks:

- F&OR (Functional & Operational Requirements)

- Analysis of Alternatives

- Structured cost and reliability modeling

- Operational-scenario analysis

Deep-tech startup missions are at least this sophisticated, yet we’ve reduced them to a single, abused readiness metric.

The Capital-Market Consequence

What really worries me is this: we now have an entire asset class—with massive societal implications—being evaluated by deeply flawed models of risk-return.

These critiques are starting to surface privately among experienced founders and investors, but they’re rarely said out loud.

They should be.

The Uncomfortable Conclusion

If this isn’t fixed, deep-tech startups are basically NFTs.