Breaking Down Speed & Scale

In climate tech, investors and entrepreneurs are faced with a new challenge: climate change can't be solved by apps. We are faced with a new frontier of having to not only create a new business, but also adapting the lessons of entrepreneurship and technology disruption in a new terrain and one that the startup ecosystem is just starting to embrace: hardware and deep tech. One of the most common models is the infrastructure startup, but we really need to think about how the business and technologies integrate to achieve Speed and Scale.

I. The Problem Constraints

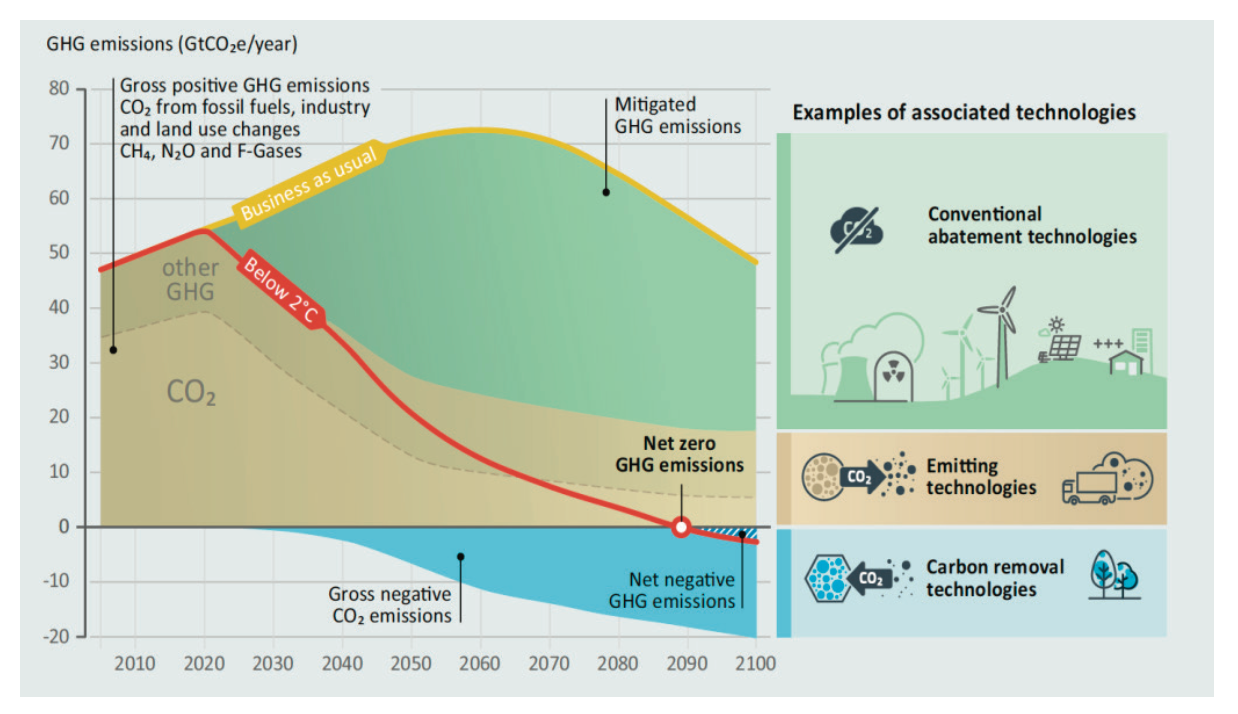

In the chart below, we can a rough roadmap of how we need to transition to net zero by 2050. The big takeaway is how much CO2 we need to stop emitting into the atmosphere immediately. Carbon removal technologies such as direct air capture have time by 2050 to reach cost effectiveness and scale, but the urgent goal is producing clean energy without CO2 emissions by 2050. Today it is 2023, which leaves us only 27 years to get the job done.

"The Engineer in me says that we're screwed. The Optimist in me says 'we have just the amount of time we need. Because it's ultimately a challenge of speed and scale, scale and speed." - John Doerr, Chairman of Kleiner Perkins Caufield & Byers, Author of "Speed & Scale"

An Optimistic Projection of our CO2 Emissions in the Future

What does this mean in terms of objectives? First, a first-order, linear-scale, brute force play won't work. This includes throwing $100B's at any one technology for the sake of naive idealism or the creation of a totalitarian one-world government that forces everyone to stop driving cars and renounce eating cheeseburgers. Second, we have to read 10 steps ahead before thinking of what solutions we really commit to. There's only so much money and there is only so much time.

II. Economies of Scale

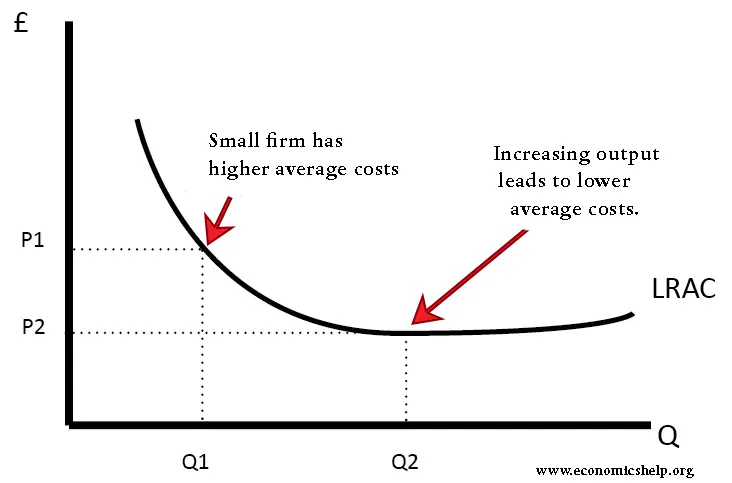

If we start with freshman level micro-economics, we'll see a graph like the one below. Economies of scale are talked about, but I rarely hear people discuss the nuances of economies of scale. I've seen many companies state that one day the cost of a certain technology will come down and create transformation. In most cases this doesn't pan out, but in some cases, it does and those who take advantage (even by luck) make a lot of money. We need to think from first principles why some technologies made it and others didn't.

Let's examine a few cases of hardware type of businesses and how they achieve economies of scale.

1) Monoliths

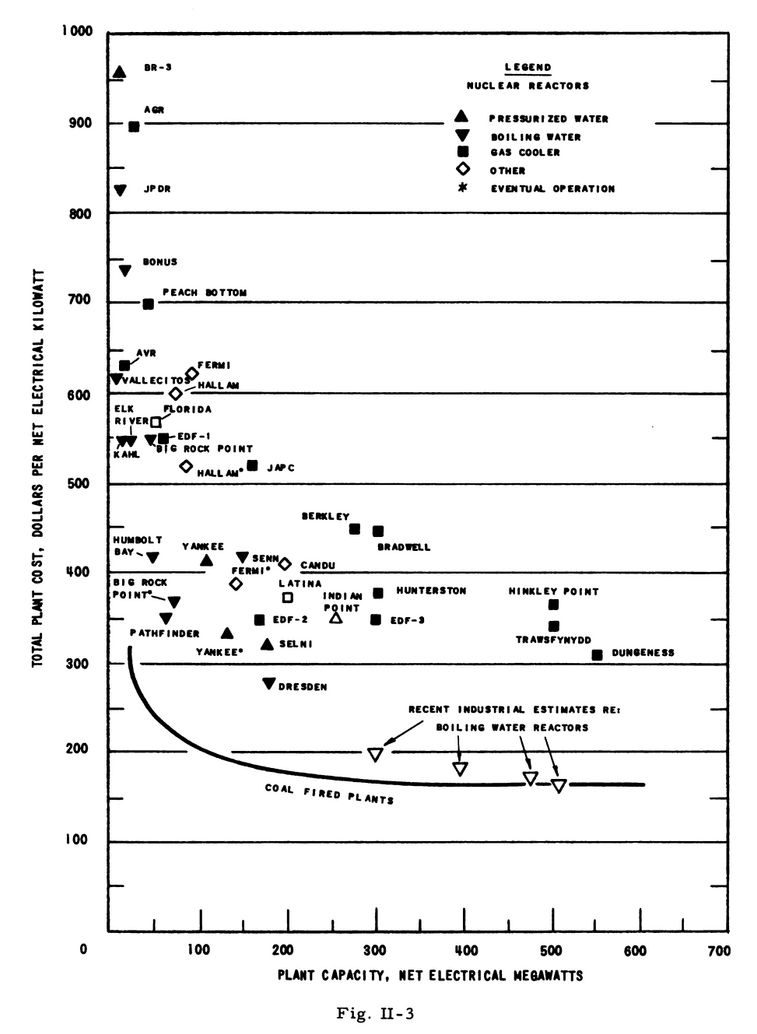

The first type of way a technology achieves economies of scale is through a monolithic centralization of production. The case that most comes to mind is nuclear power, where the higher the power capacity of the reactor, the cheaper the electricity it produces.

The downside of monoliths is how large these facilities have to be to scale effectively and the risk of a tower of babel type scenario: one keeps building bigger until the structure collapses on itself. The recent Vogtle reactors in Georgia were decades behind, nearly bankrupted Mitsubishi, and cost $31B (originally projected at $660M). Although this project was built in the end, the costs had skryocketed out of control and were decades behind. The larger the project, the more complex the execution.

Monoliths are dangerous in that the size at which costs can come down may look great on a graph, but have practical implications that hinder sucessful scalability. The bigger the plant, the harder it may be to build and finance. The bigger the plant, the size at which scale occurs to reach effectiveness may not be buildable (cost, time, physical constraints). In terms of speed of adoption, nuclear power plants did not succeed as a category. In terms of economies of scale, they also performed poorly.

We should keep this in mind with new proposed Direct Air Capture Facilities, Hydrogen Production Plants, and even Small Modular Reactors as we plan our net-zero transition by 2050.

2) Big Factories

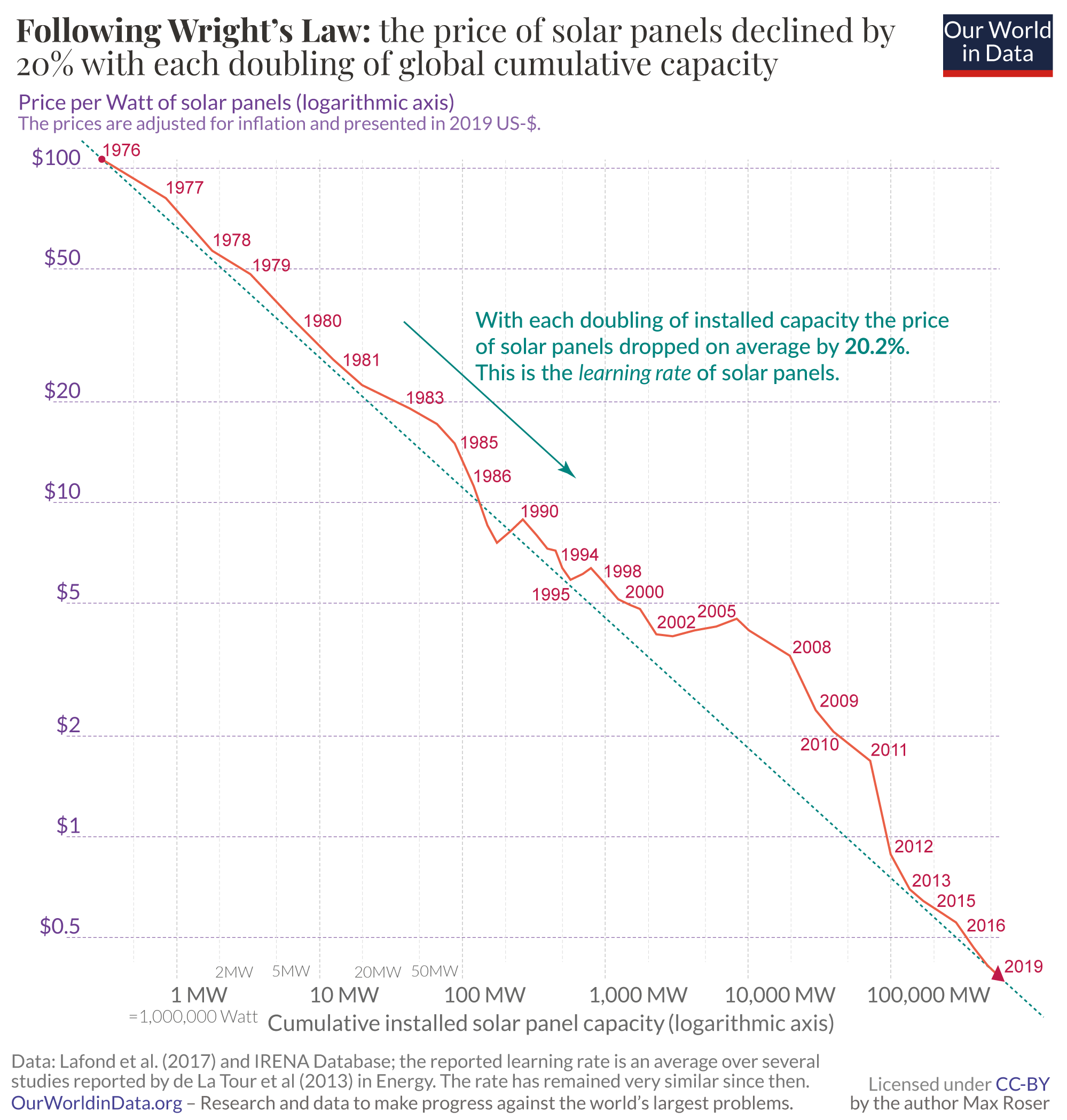

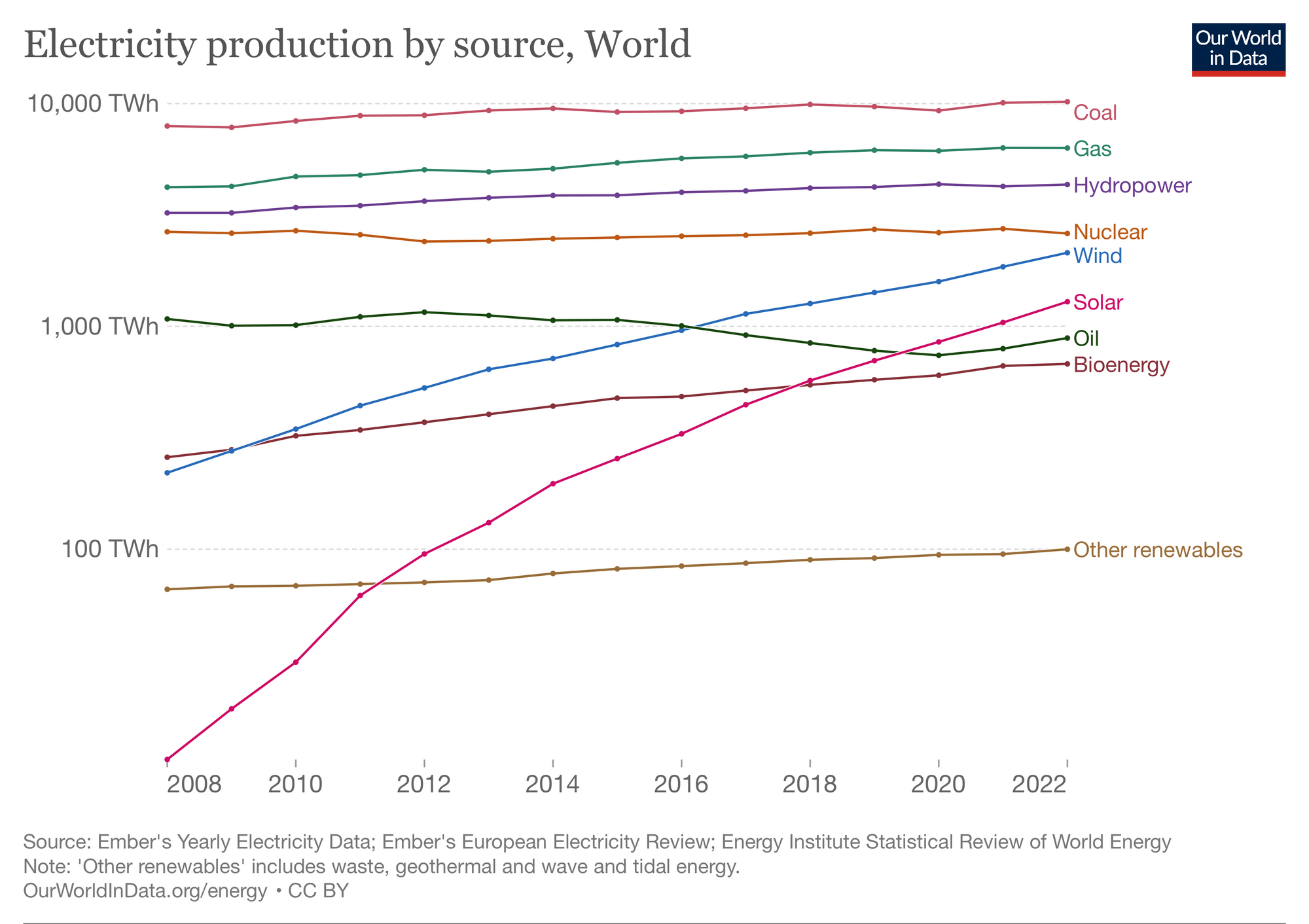

In terms of growth, solar panels have outperformed other forms of green energy (wind, biofuels, and geothermal). The growth of these forms of energy benefitted from subsidies, but there's a lot to be learned from the last 10 years of solar that may leave clues to the next 10 decades.

The speed of adoption was incredible. As shown in the figure below, solar's adoption was incredibly fast as costs dropped. It had a small unit size, which opened its options to more available capital at smaller amounts than that of a nuclear power reactor. $20k-$25k for a residential setup or $100m's for commercial solar power plants are easier to obtain than $31B for a centralized nuclear power plant.

The price of solar panels exhibit incredibly economies of scale, but has drawbacks. Solar's economies of scale are quite interesting. With every doubling of installed capacity, the price per unit of solar panels come down by 20%.

From the perspective of a deep tech entrepreneur, the success of monocrystalline solar panels is disappointing. The era was led by the least innovative technology of the category as a commodity. This isn't a formula for success for a startup riding on the wave of the transition to sustainable energy. A dominant design had proved "good enough" and money was plowed into capacity such that one could ride the cost curve until solar became the cheapest form of electricity in the world.

In terms of power generation, solar panels can be installed in small, discrete units (250-400W compared to GW for a nuclear power plant), which allows it to be deployed quickly once produced. The hidden monoliths come from the large facilities necessary to build them, which can scale to billions of dollars.

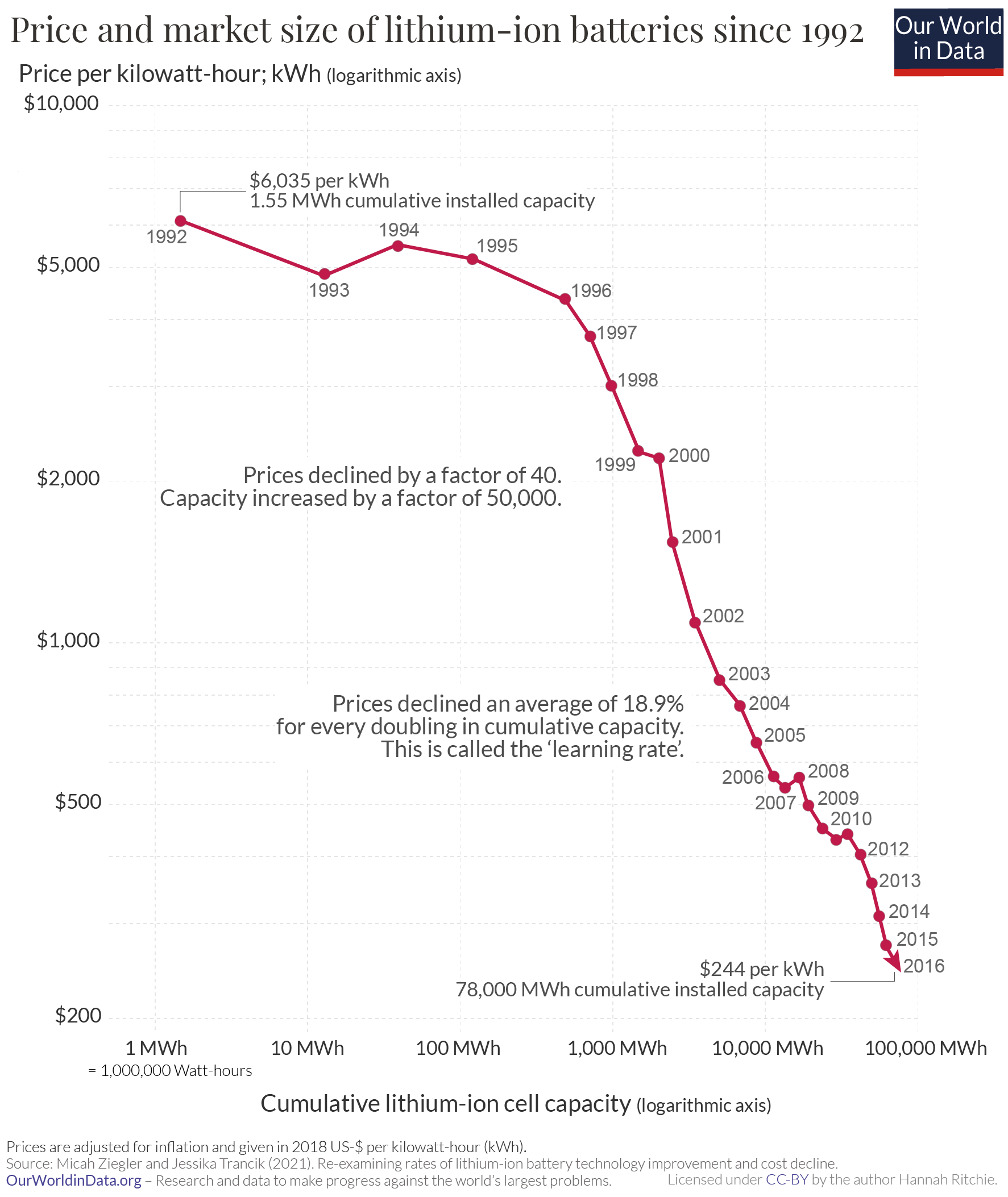

Today, we are seeing a very similar pattern as we speculate on energy storage in the future. Li-ion batteries have demonstrated their practical use in electric vehicles and the same forcing function that we witnessed could play out in this era as well. The learning curve is in-line with that of solar panels also falling 20% with every doubling of capacity. The pattern is forming with companies like Tesla or BYD racing to build multi-billion dollar gigafactories to drive down costs.

This works very well for mature technologies that have reached a dominant design with acceptable specifications. When evaluating novel technologies, this type of inherent scalability is not suited to a breakthrough technology. At the point of building out large scale manufacturing, the type of low cost capital like debt financing is hard to obtain for a novel form factor with early stages of product market fit and at the scale of billions of dollars, the market for that much high risk capital is quite low for a venture at that stage even with a technology that works. Why take a risk on a new paradigm if it'll take billions of dollars to catch up when the incumbent technology is ahead and still falling?

Superior specifications aren't enough: speed of adoption is achieved through small-scale deployment, but true scale, one that can compete with the pulse of a mature technology where big industry is plowing billions of dollars in a race to the bottom must have a superior cost-curve driven by fundamental physics and a superior manufacturing process.

This is important to note as we look at the last decade of progress in solar and why the innate economies of scale of batteries will be important as the world watches for strong contenders to Li-ion batteries.

III. What We Are Looking For

After this exploration of speed and scale, in order to get to net zero by 2050, we need impactful technologies that have innate properties that enable speed and scale. Although the learning curves of Photovoltaics and Li-ion batteries are changing the world with great progress, in the quest to mitigate the effects of climate change, they are not enough; we'll require faster speed and and faster economies of scale with the limited time we have.

Speed

To achieve speed of adoption, new physical technologies require a small, discrete size. Technologies that can be built (and licensed) quickly (1-2 years) able to financed at plant levels in the $10M's to $100M's. The dearth of high risk capital for billions of dollars precludes success. Once technical development and product market fit are achieved, speed of adoption can be achieved greatly for physical assets at this size. An extreme example is the case of franchises. Once they get going, they can scale across the country in a matter of years.

Scale

We need a great impact for breakthrough technologies that can transcend the performance of today's energy assets. Batteries need to last longer, become cheaper, use materials that are earth-abundant with resilient supply chains. In order to compete with these learning curves amongst superior technologies, commercially deploying fast enough to make a meaningful impact in time to reach net zero by 2050, the scale will come from breakthrough designs with manufacturing processes that achieve cost parity through superior learning curves. The conditions for low cost must be achieved with manufacturing facilities that are also in the $100M's not $B's. High throughput for a given facility and staff lowers the cost of plant and labor per unit output. Technologies can also scale if they have greater performance for a given footprint (e.g. semiconductors).