Limiting Beliefs About Earning Money: Breaking the Scarcity Cycle

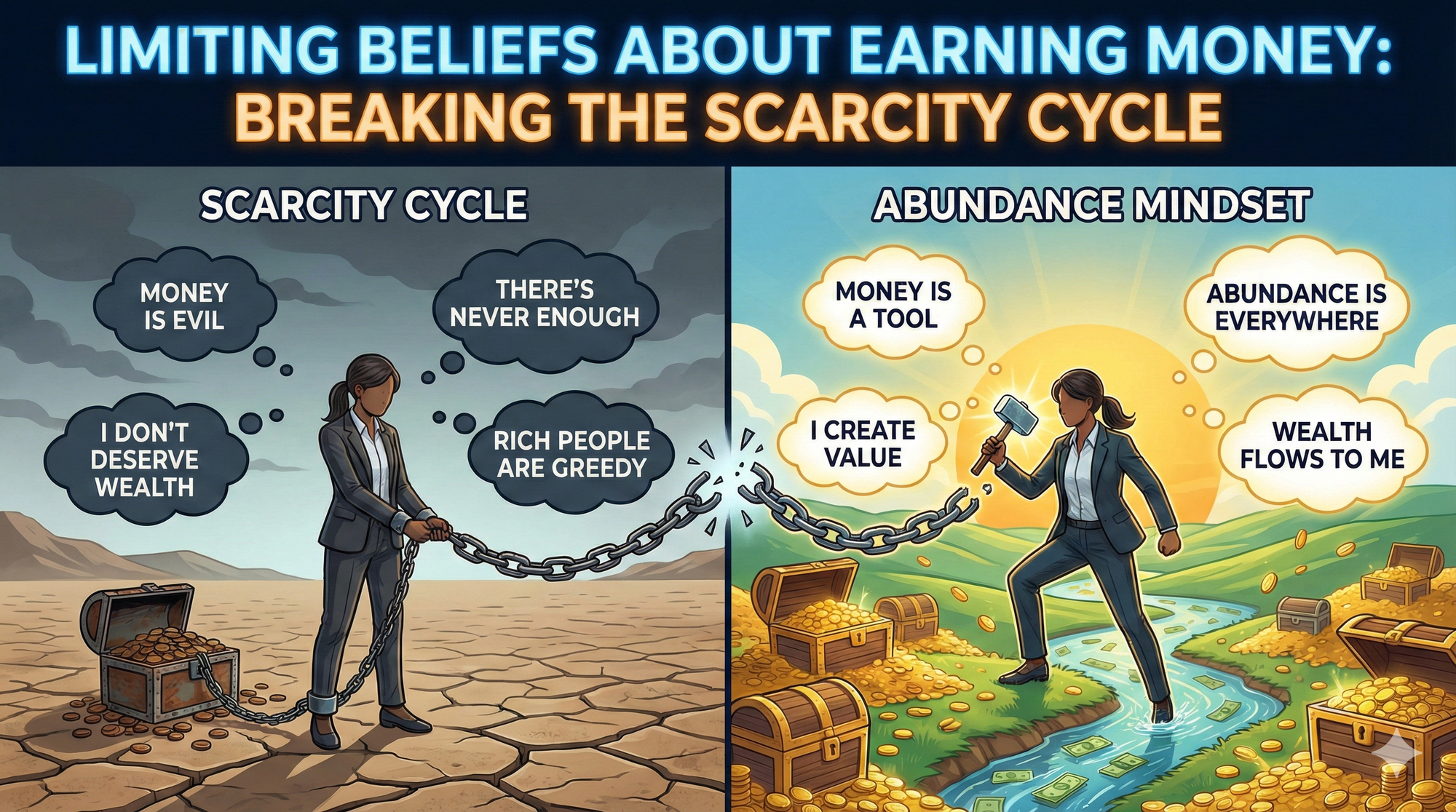

Are invisible chains holding back your wealth? This article helps entrepreneurs identify and dismantle deep-seated limiting beliefs about earning money.

I. Introduction: The Invisible Chains on Your Wealth Potential

Let's be honest. For many of us, the path to financial abundance isn't just about grinding harder or finding the next big opportunity. It's often about battling invisible forces: limiting beliefs about money.

These aren't just fleeting thoughts; they're deep-seated convictions, often absorbed from childhood or society, that can quietly, relentlessly, sabotage even our most ambitious entrepreneurial efforts.

You might crave wealth, but if there's an underlying distrust of the wealthy, or a subconscious belief in the "righteousness" of scarcity, you're setting yourself up for an internal conflict. That conflict? It kills financial growth. This article isn't just going to talk about these psychological barriers; we're going to dig in, identify them, and then, together, dismantle the limiting beliefs that are holding back the financial success you absolutely deserve.

Why Entrepreneurs Struggle with Wealth: A Direct Answer

Entrepreneurs often hit a wall with wealth, not because they lack hustle or opportunity, but because of deeply ingrained limiting beliefs about money. Think about it: if you secretly believe wealth is corrupt, or that struggling financially makes you a better person, you're creating a massive internal resistance.

This stops you cold from truly embracing and pursuing financial abundance. The real game-changer? Identifying and then actively reframing these subconscious narratives. Do that, and you unlock your true earning potential, cultivating a mindset that actually welcomes lasting prosperity.

II. The Roots of Financial Limiting Beliefs

Our relationship with money? It's complicated. It's a messy tapestry woven from childhood experiences, cultural stories, and every financial win and loss we've ever had. Many entrepreneurs, despite their relentless drive, carry these subconscious beliefs that act like a psychological ceiling on their earning potential. It's what I've seen manifest as that "distrust of wealthy people" or a "bias of righteousness towards those that lack"—a point I touched on in my original post on Limiting Beliefs. This internal tug-of-war? It's a prime setup for self-sabotage, where we unconsciously dodge or undermine opportunities for real financial growth.

Common Money Blocks for Entrepreneurs

Entrepreneurs, especially, run into specific limiting beliefs that just slam the brakes on their financial progress. Spotting these patterns is half the battle won:

- "Money is the root of all evil": This old chestnut. It can lead to an unconscious aversion to building wealth, making you equate financial success with some kind of moral compromise. It's an axiomatic characterization that can be toxic for performance.

- "I'm not good with money": This isn't just a thought; it's a self-fulfilling prophecy. It often leads to poor financial decisions or a flat-out refusal to even engage with financial planning. You avoid it, so you never get good at it.

- "Rich people are greedy/selfish": If you believe this, you're fostering a subconscious fear of becoming wealthy yourself. Why? Because it clashes with your self-perception as a good person. You can't be both, right? Wrong.

- "There's not enough to go around": This is the scarcity mindset talking. It shrinks your perceived opportunities and often pushes you into competition when collaboration would serve you better.

- "I don't deserve to be wealthy": This one often ties into feelings of unworthiness or imposter syndrome. It stops you from truly valuing your contributions and, frankly, charging what you're worth.

III. Breaking the Scarcity Cycle: Actionable Strategies

Look, overcoming these limiting beliefs about money isn't some magic trick. It demands a conscious, consistent effort to challenge those old narratives and actively cultivate new, empowering ones. This isn't just a side project; it's a core part of stepping into your "Inner Arena" and truly engaging in self-upgrading. I talked about this in the Ultimate Guide to Identifying and Overcoming Limiting Beliefs.

1. Identify Your Specific Money Blocks

Awareness is always step one. Seriously, take some time. Dig deep into your convictions about money. What phrases echo in your head? What emotions bubble up when you talk about wealth or financial success? Journaling, meditation, even a good guided worksheet can pull these subconscious beliefs into the light. For instance, if you're constantly underpricing your services, ask yourself: what's the belief making you hesitant to charge your true worth?

2. Challenge the Evidence

Once you've got them in your sights, question them. Hard. Is there any real, concrete evidence to back these beliefs up? More often than not, they're built on shaky ground: old stories, societal conditioning, or a few bad experiences, not universal truths. If you're convinced "all rich people are greedy," then actively seek out examples of wealthy individuals who are using their resources to make a massive positive impact. This process of disputation? It's central to Rational Emotive Behavioral Therapy (REBT), and it's a powerful tool for any entrepreneur.

3. Reframe Your Narrative

This is where you rewrite your script. Replace those limiting beliefs with empowering affirmations and a brand new narrative. Instead of "Money is hard to earn," try "I attract abundance effortlessly." Instead of "I'm not good with money," affirm "I am capable of managing my finances wisely and growing my wealth." Consistency here is everything. As Lynne Twist highlights in The Soul of Money, money itself is neutral; it's our interpretation and interaction with it that shapes our financial reality. Shift that interpretation, and you shift your entire financial trajectory.

4. Take Aligned Action

Belief transformation isn't just an intellectual exercise; it demands action. Start small, but start consistently. Take steps that actually align with your new, empowering beliefs. This could mean diving into financial education, making a strategic investment in your business, or simply practicing gratitude for the money you already have. Every single aligned action reinforces that new belief and builds serious momentum toward your financial goals. My Narrative -> Emotion -> Action framework isn't just theory; it underscores that action is the ultimate, undeniable outcome of your beliefs.

5. Seek Mentorship and Community

Who you surround yourself with matters. Immensely. Find individuals who embody the financial success and mindset you aspire to. Mentors can offer invaluable guidance and challenge your limiting perspectives, while a supportive community provides encouragement and accountability. Engaging with others who have successfully navigated their own money blocks doesn't just offer real-world examples; it powerfully reinforces the possibility of your own financial transformation.

IV. Conclusion: Your Path to Financial Freedom

Breaking free from limiting beliefs about earning money? It's a profound journey of self-discovery and intentional transformation. By consciously identifying, challenging, and then actively reframing these deeply ingrained narratives, you, as an entrepreneur, can unlock your full financial potential. This isn't about some magical attraction of wealth. It's about systematically removing the internal barriers that have prevented you from taking the necessary, powerful actions to create it. Embrace the "Inner Arena" work, cultivate an abundance mindset, and step boldly into the financial freedom you are absolutely capable of achieving.

Why I Wrote This

My time as an entrepreneur wasn't just about working hard; it was about seeing, firsthand, the profound impact of mindset on entrepreneurial success. I watched brilliant minds get stuck, not by market forces, but by their own subconscious beliefs about money and worth. This article? It's a distillation of those observations, blended with insights from the sharpest minds in psychology and personal development. My goal is simple: to give entrepreneurs actionable strategies to overcome their financial limiting beliefs and truly, authentically thrive.

Recommended Resources

Ready to go deeper? To truly dismantle those limiting beliefs about money and self-worth, these works are essential reading:

- The Soul of Money: Transforming Your Relationship with Money and Life by Lynne Twist: This book isn't just about money; it's about a radical shift in perspective. Twist challenges conventional views, inviting you to align your financial life with your deepest values. It's powerful stuff. Amazon Link

- The Unlimited Self: Destroy Limiting Beliefs, Uncover Inner Greatness, and Live the Good Life by Jonathan Heston: If you're looking for practical tools and raw insights to break free from self-imposed limitations, this is it. Heston empowers you to unlock your full, boundless potential. Amazon Link